An interest rate collar uses interest rate options contracts to protect a borrower against rising interest rates while also setting a floor on declining interest rates.

Interest rate floor definition.

An interest rate floor is similar to an interest rate cap agreement.

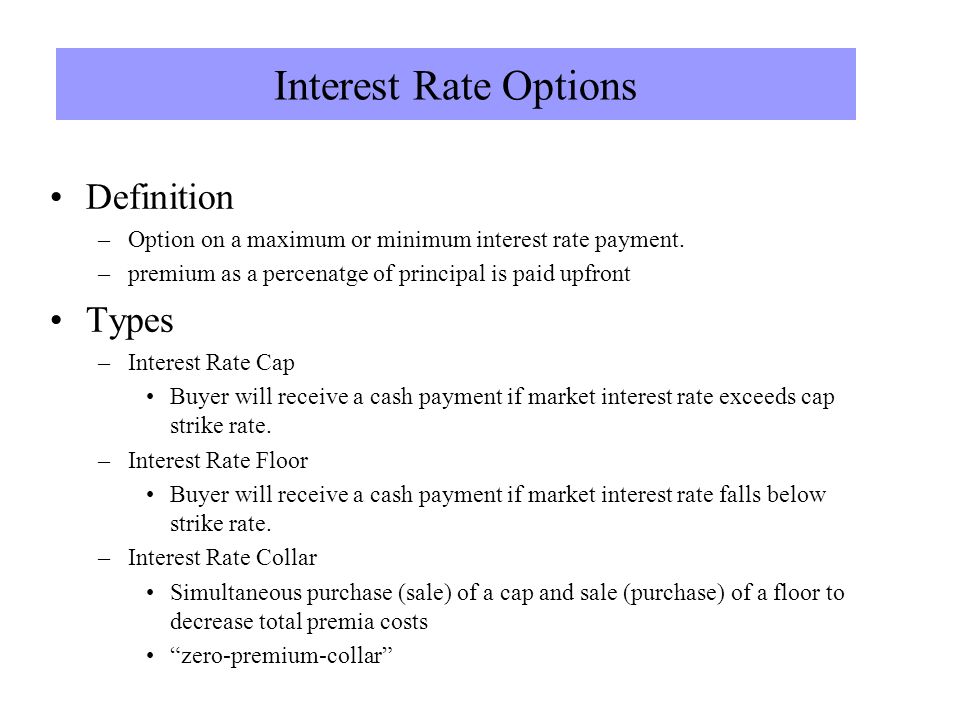

An interest rate cap is a derivative in which the buyer receives payments at the end of each period in which the interest rate exceeds the agreed strike price an example of a cap would be an agreement to receive a payment for each month the libor rate exceeds 2 5.

An interest rate floor is often present through the issuing of an adjustable rate mortgage arm as it prevents interest rates from adjusting below a preset level.

An interest rate floor reduces the risk to the bank or other party receiving the interest.

Interest rate collars and reverse collars.

For example an adjustable rate mortgage may have an interest rate floor stating that the rate will not go below 3 5 even if the formula used to calculate the interest rate would have it do so.

An interest rate floor is an agreement between the seller or provider of the floor and an investor which guarantees that the investor s floating rate of return will not fall below a specified level over an agreed period of time.

An interest rate floor is a series of european put options or floorlets on a specified reference rate usually libor.

The buyer of the cap receives money if on the maturity of any of the caplets the reference rate exceeds the agreed strike price of the cap.

This acts as protection for the buyer by ensuring that the interest rate for a product or loan does not drop below a specified rate.

An interest rate floor is an agreed upon rate in the lower range of rates associated with a floating rate loan product.

An interest rate floor is a contract associated with financial products and loans that feature floating rates.

Floor rate means a per annum rate of interest i equal to three and seventy five hundredths of one percent 3 75.

The underlying rate is known as the reference rate.

Interest rate cap and floor definition.

An interest rate floor is a series of european put options or floorlets on a specified reference rate usually libor.

The minimum interest rate that may be charged on a contract or agreement.

And ii which the note rate hereinafter defined shall never be less than while any indebtedness under this note is outstanding.

An interest rate cap is a series of european call options or caplets on a specified interest rate usually the libor interest rate.

/GettyImages-1147331105-b6d11d4d59a445c0909f2c61510df139.jpg)

:max_bytes(150000):strip_icc()/GettyImages-180734345-ec5247651d704f57a7117eee952be492.jpg)

/GettyImages-508210587-035f69f0bb23424287d09c3a93bf4735.jpg)

/GettyImages-616128066-f65b7fd4b27a4aa4a6f44009cd448283.jpg)

:max_bytes(150000):strip_icc()/GettyImages-522209078-3d1fee1a84a64894bc6a3718ec2a5499.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Zero_Cost_Collar_Apr_2020-01-3f7ffff9ccd84d9e8f93fa3cd72c8d4f.jpg)

:max_bytes(150000):strip_icc()/GettyImages-1064821934-6a28ccd7276d4f389a0d30c370e7f266.jpg)